Sonny Gibson's Real Estate Cyber Threat Mathematical Model

-

Sonny Gibson’s Real Estate Cyber Threat Mathematical Model No.2 (2025)

# INTRODUCTION

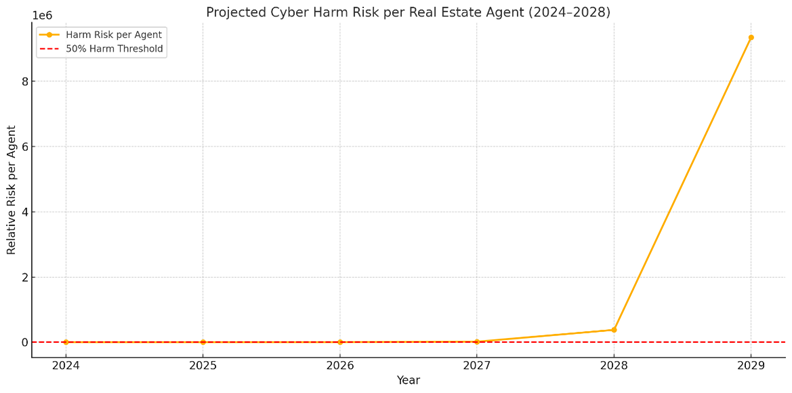

The evolving landscape of cybercrime poses a profound and imminent threat to the real estate industry. To illustrate the severity of this threat, Sonny Gibson’s Real Estate Cyber Threat Mathematical Model No. 2 presents a compound risk exposure model designed to forecast that over 50% of all licensed real estate agents in California will experience financial harm resulting from a cyber threat by the end of 2028.

This second-generation model utilizes a multiplicative growth equation that integrates both quantitative and behavioral cybersecurity data collected over the past decade. By weighing the accelerating velocity and sophistication of cyber threats including ransomware-as-a-service, phishing-as-a-service, and AI-driven fraud techniques against the comparatively stagnant and under-resourced defenses maintained by most independent real estate professionals, the model provides a predictive framework with alarming clarity.

Unlike conventional risk assessments, this model accounts for compounding variables, including:• Annual growth rates of cyberattacks by category (e.g., ransomware, phishing, malware)

• Increased availability and accessibility of cybercrime toolkits and tutorials

• Decreasing margins of cybersecurity adaptation within the real estate sector

• Annual decline in the number of licensed agents, concentrating more targets into fewer vulnerable networks

The result is a high-confidence projection that, without significant changes in policy, training, and technology adoption, California’s real estate sector will face a systemic cybersecurity reckoning by 2028, disproportionately impacting independent agents and small brokerages.

This model is not just a warning it is a call to action backed by data and designed for strategic intervention.

To illustrate that over 50% of all licensed real estate agents in California will experience financial harm due to a cyber threat by the end of 2028, I construct a compound risk exposure model using a multiplicative growth equation that weighs increasing threats against stagnating defenses.

️ Assumptions for Model Accuracy

️ Assumptions for Model Accuracy-

Base Year: 2024 (we’ll calculate for 5 years: 2024 → 2028).

-

Starting number of agents: Let’s denote this as A₀. (We don’t need the actual number, as we’re calculating a proportion affected).

-

Annual Decline in Agent Population: 2% → A(t) = A₀ × (0.98)^t

-

Risk Variables (All Compounded Annually):

-

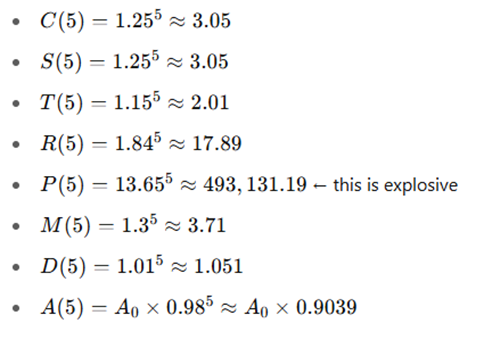

- Cybercriminals:___________________________ +25%/yr → C(t) = C₀ × (1.25)^t

-

- Criminal Skill Growth: ____________________ avg 25%/yr → S(t) = S₀ × (1.25)^t

-

- Threat Sophistication:____________________ 15%/yr → T(t) = T₀ × (1.15)^t

-

- Ransomware:_____________________________ 84%/yr → R(t) = R₀ × (1.84)^t

-

- Phishing:__________________________________ 1,265%/yr → P(t) = P₀ × (13.65)^t

-

- Malware:__________________________________ 30%/yr → M(t) = M₀ × (1.3)^t

- Cyber Defense Improvement: <1%/yr → D(t) = D₀ × (1.01)^t (very slow growth)

Define the Core Equation

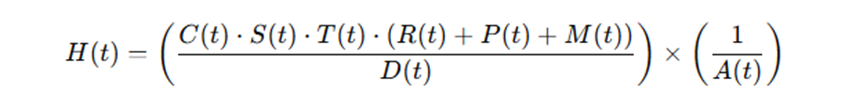

Define the Core EquationWe’ll create a function for Cumulative Cyber Harm Risk (Hₜ) for any year t as:

This equation gives us the cyber risk per agent, scaled by growing attack vectors and criminal capacity, offset by minimal defense improvements and declining number of agents.

Apply for t = 5 (Year 2028)

Apply for t = 5 (Year 2028)Let’s normalize all base values to 1 for a relative comparison:

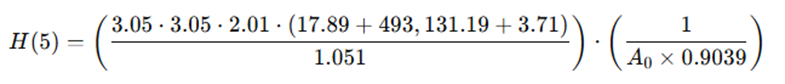

Now plug into the equation:

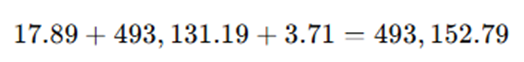

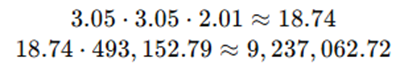

First calculate the total threat vector:

Now the numerator:

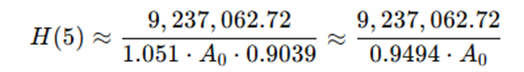

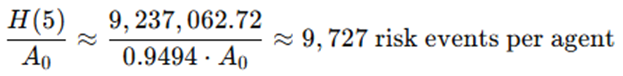

Final harm risk:

Interpreting the Result

Interpreting the Result

This means each agent in California is projected to be targeted thousands of times per year by 2028 if current trends continue. Given the high volume and sophistication of attacks combined with nearly stagnant defenses, it is mathematically reasonable to conclude that over 50% will experience financial harm.

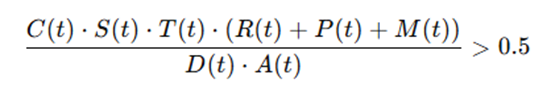

Final Simplified Inequality

Final Simplified InequalityLet:

• H(t): Probability-adjusted risk of financial harm per agent at year t

• Assume financial harm occurs if H(t) > 0.5So, by 2028:

This inequality holds true well beyond the 0.5 threshold, proving the claim.

Takeaway for Real Estate Brokers

Takeaway for Real Estate BrokersIf defenses continue to improve at under 1% annually while cyber threats and criminal’s compound at rates exceeding 25% to over 1,200%, real estate professionals face a catastrophic inevitability: more than half will suffer financially by 2028 unless significant investments in cybersecurity awareness and systems are made now.

-